Introduction: Why Understanding Personal Finance vs Financial Literacy Matters

In today’s economy, understanding money is no longer optional — it’s a necessity. Yet, terms like personal finance and financial literacy are often used interchangeably, even though they’re not the same thing. Understanding the difference can help you make more informed decisions, build wealth, and avoid costly mistakes.

In this comprehensive guide, we break down the distinction between personal finance and financial literacy, explain why both are essential, and provide actionable steps to improve in each area. Whether you’re a beginner or looking to level up your money management skills, this guide is designed for you.

What Is Personal Finance?

Personal finance refers to the management of your individual financial activities — everything from earning, saving, investing, and budgeting to planning for retirement. It’s the practical application of money skills to your everyday life.

Key Areas of Personal Finance

- Budgeting – Tracking income and expenses.

- Saving – Building emergency funds and savings goals.

- Investing – Growing wealth through stocks, bonds, real estate, or mutual funds.

- Debt Management – Handling credit cards, student loans, or mortgages effectively.

- Retirement Planning – Preparing financially for life after work.

Personal finance is about action and execution — how well you manage the money that comes into and leaves your hands.

What Is Financial Literacy?

Financial literacy is the knowledge and understanding of financial concepts that help you make informed money decisions. It’s about knowing how money works and what tools are available to you.

Core Elements of Financial Literacy

- Understanding how credit scores work.

- Knowing the basics of compound interest.

- Recognizing the importance of diversification in investing.

- Being aware of financial risks and fraud.

- Understanding taxes, insurance, and financial regulations.

Where personal finance is the practice, financial literacy is the education that drives smarter financial actions.

Personal Finance vs Financial Literacy: The Key Differences

| Aspect | Personal Finance | Financial Literacy |

|---|---|---|

| Definition | Managing your personal money and financial activities. | Understanding financial concepts and principles. |

| Focus | Execution and decision-making. | Knowledge and comprehension. |

| Outcome | Achieving financial goals like debt freedom or retirement savings. | Making informed financial choices and avoiding mistakes. |

| Example | Creating and sticking to a monthly budget. | Understanding what a budget is and why it’s important. |

In short, financial literacy fuels personal finance. Without knowledge, your financial decisions may lack strategy. Without action, knowledge alone won’t change your financial situation.

Why Both Are Equally Important

Mastering one without the other creates a gap:

- High Literacy, Low Action: You know what to do but fail to implement it.

- Low Literacy, High Action: You act but often make uninformed decisions, leading to mistakes.

To build lasting wealth and stability, you need a balance of knowledge and practice.

Building Strong Financial Literacy: The Foundation

1. Educate Yourself

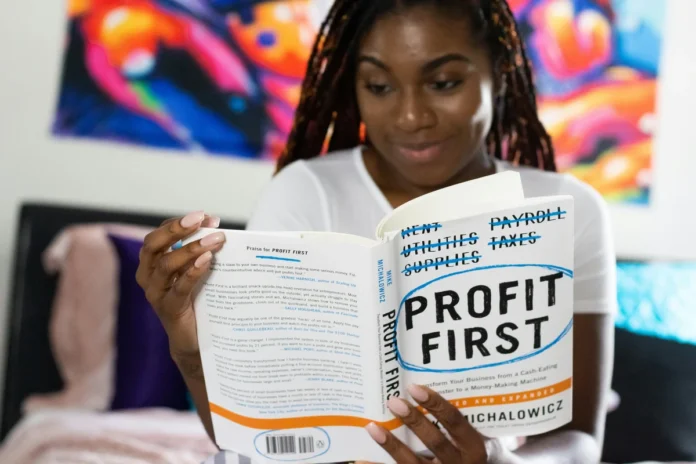

- Read reputable books like Rich Dad Poor Dad or The Total Money Makeover.

- Follow trusted websites such as Investopedia or NerdWallet.

- Listen to financial podcasts for ongoing learning.

2. Learn Basic Financial Concepts

- How interest rates affect loans.

- How to evaluate investment opportunities.

- Understanding risk and diversification.

3. Stay Updated

Financial laws, tax codes, and market trends evolve. Staying informed keeps your literacy sharp and relevant.

Applying Knowledge to Personal Finance: From Learning to Doing

Once you understand financial principles, it’s time to apply them to your life.

1. Create a Budget That Works

- Use tools like YNAB or Mint.

- Allocate income to essentials, savings, and discretionary spending.

2. Build an Emergency Fund

- Start with at least $1,000.

- Aim for 3–6 months of living expenses over time.

3. Manage and Reduce Debt

- Pay off high-interest debt first (credit cards).

- Use methods like the debt snowball or avalanche strategy.

4. Start Investing Early

- Open a retirement account like a 401(k) or IRA.

- Begin with low-cost index funds or ETFs.

5. Protect Your Assets

- Get the right insurance (health, auto, home, life).

- Build a will or estate plan for your family.

Common Mistakes in Personal Finance and Financial Literacy

Personal Finance Mistakes

- Overspending due to lack of budgeting.

- Ignoring emergency savings.

- Delaying retirement contributions.

Financial Literacy Gaps

- Not understanding compound interest.

- Misinterpreting loan terms.

- Falling for scams or predatory offers.

Recognizing these pitfalls is the first step toward avoiding them.

How to Improve Both Simultaneously

- Start Small, Stay Consistent – Set one actionable financial goal per month.

- Track Your Progress – Use financial apps to monitor improvements.

- Join Communities – Online forums like Reddit’s r/personalfinance can offer support and shared experiences.

- Consult Professionals – A certified financial planner (CFP) can bridge your literacy and execution gaps.

Real-Life Example: The Power of Knowledge and Action

Consider two individuals:

- Alex has high financial literacy but never invests.

- Jamie starts investing without research, choosing random stocks.

Both struggle because knowledge without action and action without knowledge lead to missed opportunities or financial loss. But someone who learns about index funds and then consistently invests in them is set up for long-term success.

To get more knowledge about Personal Finance, visit: Introduction to Personal Finance

Conclusion: Striking the Balance Between Knowledge and Action

Understanding personal finance vs financial literacy isn’t just a semantic exercise — it’s the foundation of financial success. Knowledge teaches you what to do, and personal finance practices ensure you actually do it.

Start small, stay consistent, and remember: your financial future is built one informed decision at a time.

GET MORE KNOWLEDGE ABOUT FINANCE BY VISITING: FTECH

Call to Action

Ready to take control of your finances? Start today by setting a simple goal — like creating a budget or reading a financial book — and build from there. Your journey toward financial freedom begins with one step.

FAQs

1. What is the main difference between personal finance and financial literacy?

Personal finance is about managing your money, while financial literacy is about understanding how money works.

2. Can I improve my financial situation with just financial literacy?

No, knowledge alone isn’t enough. You need to apply what you know to see real results.

3. How can I start improving both areas today?

Start with education — read a book or take a free course — and set one actionable goal like building a small emergency fund.

4. Are there free tools to help manage personal finance?

Yes, apps like Mint, YNAB, and Personal Capital can help you track spending, save, and plan for the future.

5. Why is financial literacy important in 2025 and beyond?

With inflation, economic uncertainty, and evolving financial products, staying informed ensures you make smarter, future-proof decisions.