Introduction: Why Most People Struggle With Budgeting

If you’ve ever tried to set up a budget, you probably know how easy it is to quit after a few weeks. Spreadsheets, endless categories, tracking every single coffee or subscription—it feels like more work than it’s worth.

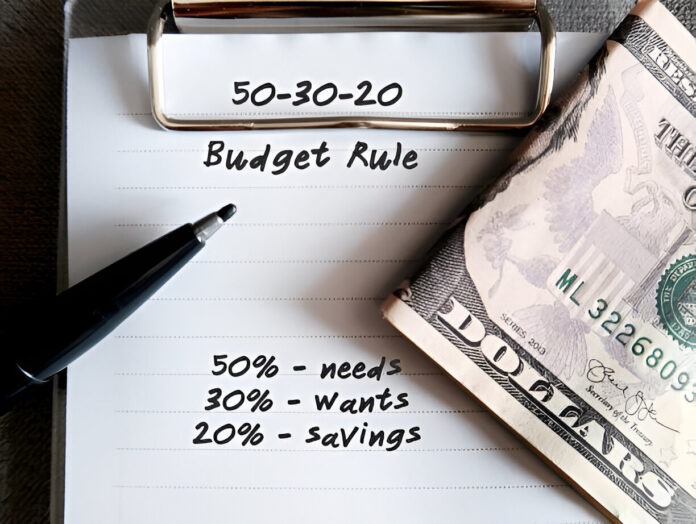

But here’s the thing: managing money doesn’t have to be that complicated. In fact, one of the most popular budgeting methods today is built on just three numbers: 50, 30, and 20.

The 50/30/20 rule for personal finance is designed to keep things simple without sacrificing effectiveness. Instead of micromanaging every expense, it divides your after-tax income into three straightforward categories—needs, wants, and savings.

And the best part? It’s flexible. Whether you’re earning $3,000 a month or $13,000, this rule gives you structure while leaving room for your lifestyle.

Let’s break it down and see how it can help you finally create a budget that sticks.

What Exactly Is the 50/30/20 Rule for Personal Finance?

The 50/30/20 rule is a budgeting guideline that says you should split your monthly after-tax income like this:

- 50% for Needs → essentials like housing, groceries, utilities, transportation, and insurance

- 30% for Wants → discretionary spending like eating out, shopping, hobbies, or travel

- 20% for Savings and Debt Repayment → building an emergency fund, retirement contributions, investments, and paying off debt faster

This idea was popularized by Elizabeth Warren (before she became a U.S. Senator) and her daughter, Amelia Warren Tyagi, in their book All Your Worth: The Ultimate Lifetime Money Plan. Since then, it’s become one of the most widely recommended budgeting frameworks because of its simplicity and adaptability.

Think of it as a budgeting “rule of thumb” rather than a rigid law. The numbers give you balance, but you can adjust them slightly to match your real-life situation.

Breaking Down the Three Categories

1. 50% for Needs

“Needs” are the non-negotiables—the bills you must pay to live and work. This includes:

- Rent or mortgage payments

- Utilities (electricity, gas, water, internet, phone)

- Groceries and household essentials

- Car payments, gas, insurance, or public transportation

- Health insurance and medical costs

- Minimum debt payments

👉 A quick test: If losing it would seriously affect your health, shelter, or ability to earn a living, it’s a need.

If your needs are eating up more than 50% of your income, that’s a sign to look at big-ticket items like housing or transportation to see where you might cut back.

2. 30% for Wants

This is where life gets fun. “Wants” are the things that make your day-to-day more enjoyable, but you could technically live without them. Examples:

- Dining out, takeout, or bar nights

- Streaming services (Netflix, Spotify, Disney+)

- Travel and vacations

- New clothes or tech gadgets

- Concerts, sporting events, hobbies

Many people overspend here—and that’s okay if you’re aware of it. The 30% rule keeps it in check so you can enjoy yourself without sacrificing your future.

3. 20% for Savings and Debt Repayment

This is the category that sets you up for long-term financial stability. Your 20% might include:

- Emergency fund contributions (aim for 3–6 months of expenses)

- Retirement savings (401(k), IRA, Roth IRA)

- Extra payments toward student loans, credit cards, or mortgages

- Investment accounts for long-term goals

- Saving for big purchases like a house down payment

👉 One of the best strategies here is “pay yourself first.” Automate your savings so money goes straight to your savings or investment accounts before you even see it.

Why the 50/30/20 Rule Works

There’s a reason this rule has stood the test of time:

- It’s easy to follow. You don’t need to track dozens of categories—just three.

- It balances present and future. You get to enjoy your money now while still planning ahead.

- It’s flexible. You can adjust percentages when life changes.

- It builds habits. The 20% savings rule helps you consistently build wealth over time.

Traditional budgets often fail because they’re too rigid. The 50/30/20 rule is built around the way people naturally spend, making it much easier to stick with long-term.

How to Apply the 50/30/20 Rule to Your Life

Here’s a step-by-step process to put this rule into action:

- Figure out your after-tax income. Look at your paycheck after federal, state, and Social Security taxes are taken out.

- Do the math. Multiply that number by 0.5, 0.3, and 0.2. These are your spending limits.

- Sort your expenses. Go through your last 1–2 months of spending and categorize them as needs, wants, or savings/debt.

- See where you stand. Are you overspending in wants? Are needs above 50%? Use this as your starting point.

- Make small adjustments. You don’t have to overhaul everything overnight. Even shifting 5–10% can put you back on track.

- Automate savings and payments. The less manual effort, the more likely you’ll stick to it.

- Check in monthly. Life changes. Revisit your percentages to make sure they still work.

Example Budget Using the 50/30/20 Rule

Let’s say your take-home pay is $5,000 per month. Your budget might look like this:

- Needs (50%) = $2,500

- Rent: $1,600

- Utilities: $250

- Groceries: $500

- Transportation: $150

- Wants (30%) = $1,500

- Dining out: $400

- Streaming & subscriptions: $100

- Travel fund: $500

- Shopping: $500

- Savings/Debt (20%) = $1,000

- Retirement contributions: $500

- Emergency fund: $250

- Extra student loan payment: $250

This breakdown allows you to cover essentials, enjoy life, and still build financial security.

Benefits of the 50/30/20 Rule

- Reduces decision fatigue—you don’t need to overthink every expense

- Encourages healthy balance between enjoying today and saving for tomorrow

- Works with almost any income level

- Creates a framework for tackling debt without giving up all your wants

- Makes it easier to plan for big life changes like buying a house or starting a family

Potential Drawbacks (and How to Handle Them)

- High living costs: In expensive cities, “needs” may exceed 50%. In that case, adjust to 60/20/20 or 70/20/10.

- Variable income: Freelancers or gig workers may need to base budgets on their lowest expected monthly income.

- Aggressive goals: If you’re trying to retire early or pay off debt fast, you may need to save more than 20%.

The key is to treat the 50/30/20 rule as a flexible framework—not a hard rule.

Alternatives and Variations

- 70/20/10 Rule: 70% needs/wants combined, 20% savings, 10% debt repayment.

- 60/30/10 Rule: 60% essentials, 30% discretionary, 10% savings.

- 80/20 Rule (Pareto Principle): 80% for spending, 20% for saving.

If the 50/30/20 breakdown feels off, these tweaks might fit your lifestyle better.

Final Thoughts: Keep It Simple, Keep It Consistent

The 50/30/20 rule for personal finance works because it’s simple, flexible, and realistic. It doesn’t ask you to track every penny or give up everything you enjoy—it just gives you a balanced framework to follow.

If budgeting has felt overwhelming in the past, this might be the reset you need. Start with your after-tax income, apply the percentages, and adjust from there.

💡 Next Step: Try it for just one month. At the end, see how you feel. Chances are, you’ll find yourself less stressed, more in control, and finally moving forward with your financial goals.

To get more information about Personal Finance, visit: Introduction to Personal Finance

FAQs:

Q1. Is the 50/30/20 rule realistic with today’s cost of living?

Yes, but it may need adjusting. If your rent or childcare takes up more than 50%, try shifting percentages instead of abandoning the rule.

Q2. Should debt repayment go under “needs” or “savings”?

Minimum payments go under “needs.” Any extra debt payments come out of the 20% savings category.

Q3. Can I use the 50/30/20 rule if I’m living paycheck to paycheck?

Yes. Start by focusing on covering your needs. Even saving 5–10% is progress.

Q4. Should retirement contributions through my employer count toward the 20%?

Yes, employer-sponsored retirement savings (401k, IRA) count as part of your 20%.

Q5. What if I want to save more than 20%?

That’s great! The rule is a minimum guideline—if you can save 30–40% without straining, you’ll reach financial freedom faster.